This is the longer version of an article I had published by Strategic Risk Magazine recently which can be found here: Strategic risk article

A few years ago I was asked by Strategic Risk Magazine to record a short video on what I would like to see change and improve in the Risk Management Profession. Having reviewed the video in the last few days I wanted to see if it was still relevant (Hint: yes it is! now more than ever!) Since I recorded the video, we have all gone through a Pandemic that has lasted 2 years and had a major impact on businesses, countries and societies globally. The video can be watched here:

During these last couple of years, aside from the crisis meetings focused on survival, we have seen organisations focus on restructures, new strategies and business models changing. Amongst other things, digital technology adoption and transformation initiatives have been accelerated. These are all areas where risk managers and risk departments should thrive, providing added value support for decision-making.

Unfortunately, this has not always been the case. Whilst I have seen Risk Mangers being brought to the top table for their insights and support during the pandemic I have also (and far too often) seen Risk Management (and therefore the risk managers) being cast aside or forgotten about for these important decision making meetings and initiatives. I therefore believe, now more than ever, that the suggestions in my video are even more relevant than before. So what are the key suggestions? Of course this is not an exhaustive list, however here are the three areas I discuss, all of which requires the risk manager to wander away from the comforts of their office desk.

Getting a seat at the top table

Risk Management / the Risk Manager needs a seat at the top table. If Risk Management isn’t featuring in decision making at the top levels, then what is the worth of having a risk management program? The Question is how do risk managers get invited?

As a first step, risk managers should be knocking on the door and asking for an invite. It is surprising how often this works. Assuming this doesn’t work then its important to catch their attention by demonstrating value.

During filming of “Risk Managers Getting Coffee” a question I often asked the guests was “What makes a great risk manager… what do you look for when recruiting for such a role?” The overwhelming answer was always around the soft skills. Communication, relationship building, adaptability, strategic mindset and a salesman-like ability to sell risk management. Whilst quantitative analysis skills, industry knowledge and company knowledge featured in the answers, they were always second to the important soft skills. These skills play a key role in being able to demonstrate the value of risk.

The risk manager needs to Identify influencers and allies who they may be able to approach to get an invitation in the first place. Failing an invitation, at the very least, it may give them a heads up as to when those important meetings are happening (This doesn’t need to be senior leadership meetings but it could be important innovation meetings, digital transformation meetings, project meetings etc). It also gives risk managers a starting point for relationship building in order to develop trust and an understanding of the value that risk management can bring them.

In order to demonstrate true value, the risk manager first needs to understand what is important to their senior executives and learn to speak their language. If the risk manager can understand what is close to their heart, such as a pet project or initiative, it’s a great starting point to offer help or support. And what does support look like?

There are numerous ways a risk manager can add value to senior executives. One way is simply meeting their team and discussing risks to the initiative/decision/project with the team and reporting this back to support decision making. Other approaches include optimising insurance programs, offering solutions to risks or running quantitative risk analysis. Quantitative risk analysis (QRA) can be tricky as it would require information and more time with their teams which may not be an option, however, where possible, then providing QRA data (in a digestible and visual format) will be something that decision makers will not be used to seeing and will usually leave a lasting impression, and with it, an invitation to the top table thereafter.

Its important to point out at this time that a senior exec is unlikely to be impressed if the risk manager only comes to them with roadblocks, negative risks or doom and gloom. Therefore it would be wise to consider opportunities and solutions to the risks or indeed what the deviations (both positive and negative) to the objectives may be when reporting back.

Gain Staff buy-in

Whilst proving value to top management and gaining their support is vital, equally as important is ensuring that the wider staff are on board. They are being asked to identify risk. They are asking to take time out of their jobs to support a risk management program that they often don’t understand, don’t see the value of, or don’t receive feedback from. It is therefore important to focus on communication. If people take their time to identify risk in their departments then the risk manager better make sure that they receive a proper thanks along with feedback on how their risks are supporting decision making or being escalated and used at the highest levels. This can be achieved by producing newsletters, creating (interesting and visual) annual risk reports, undertaking roadshows, creating videos, or getting away from the desk and meeting people on an individual basis daily.

Whether it be department managers or individual staff members, its important for the risk manager to understand what motivates them and again requires the risk manager to get out into the business and talk to people to understand their concerns about the risk management process as well as getting to know how busy they are (and at what times of the year they are most busy), the challenges in their job role, the challenges to their objectives, what motivates them (money, exposure to senior management, recognition etc). . This one-on-one time can be used sell risk management but also use another important risk manager skill, listening. These discussions alone already set the risk manager up with:

- identified risks (without the need for the staff members to go through a boring form or formal process and offering a great starting point for them)

- an understanding of the time-consuming or frustrating aspects of the ERM program that could be improved as well as how they like to receive information (detail vs visual for example)

- a good idea of how staff can be supported better to either avoid busy periods or receive additional support

- the opportunity to explain why risk management is important and how it might help them and their departments.

- a starting point for developing incentives and motivations for identifying risk and developing a positive risk culture

Risk Culture

Without the right risk culture in an organisation there is a good chance that even the best designed risk management program will fail. Risk Culture is the combination of values, attitudes and behaviours within an organisation in relation to risk management. This creates the foundations of an organisations approach to risk as it affects all risk decisions and ultimately the delivery of business objectives.

Building a positive risk culture takes time and effort. There is a large amount of work that needs to go into developing a positive risk culture which can take up several articles in itself however we will highlight a few of the key areas. We already discussed the importance of obtaining buy-in from the top as well as from all other staff in the organisation. In addition to this, developing a positive risk culture requires extensive training and hearts and minds sessions as well as constant communication to ensure an organisation-wide understanding of risk management and its benefits.

This requires the risk manager to be visible, approachable and an ally to the business. The following is a list of areas where the risk manager should be actively involved and will be the subject of a separate article that will go into further details.

Training

Risk Management Training forms a fundamental part of developing a positive risk culture. It is not only the technical aspects of the training but the hearts and minds.

Risk Workshops

The Risk Manager needs to act as a support to the organisation when it comes to identifying risks. Identifying risks consistently doesn’t happen overnight Facilitating risk workshops on behalf of departments can help them ease into the process.

Risk Champions

Risk champions can be a powerful tool in an organisation with few staff in a risk department. The risk champions, with the right training and understanding of the framework, along with the right personality and engagement, can act as culture builders in their own departments or functions.

This brings me back to the fact that the risk manager needs to be away from their desk more often than not and ask the right questions. They need to be seeing their risk champions, understanding what will motivate them.

Read more information about educating risk champions and building a successful champions network)

VIDEO CONTENT – Read about the Risk Culture Conversations and WATCH the videos here

Soft Skills of a Risk Manager and the Covid challenge

Essentially, what Risk Managers need to focus on, in order to take the risk profession forward, is their soft skills such as presentations skills, listening, speaking the language of staff, diplomacy and collaboration to name a few. Communication is ultimately key. Getting away from the desk and out into the business and communicating their aspirations and asking the right questions of staff to better develop a risk framework that fits in with their schedules and type of work and actually starts to add value to them.

But, this is not as easy when the organisation and its staff are dispersed. As we have seen this past couple of years, COVID has altered the way we work. Overcoming this obstacle is where another key skill comes into play: creativity.

If there are concerns about social distancing and not being able to meet one-to-one, or in groups in the office, then think differently. There are a number of alternatives that might work, such as holding outdoor meetings, investigating and using new technologies, hosting highly interactive and visual virtual meetings and workshops and/or adding risk as a regular agenda item in weekly team meetings and ensure that you attend as many as you can.

As we continue to navigate through the crisis, let us lean on our soft skills to better leverage the technical skills we, or other team members may have, to improve risk management now and into the future.

Money is why we take risk as the essence of any business is to take risk for reward, so we have to watch the money, bad cash flow kills companies, and as we see more and more now, so does greed. Find that balance between risk and reward and always remember that you can only take more risk, as you get better at risk management, thus more money is a result of better risk management, nothing else. Those who still see risk management as preventing things from going wrong will differ with me here; those who understand that risk management is about management of risk and opportunity will understand and agree.

Money is why we take risk as the essence of any business is to take risk for reward, so we have to watch the money, bad cash flow kills companies, and as we see more and more now, so does greed. Find that balance between risk and reward and always remember that you can only take more risk, as you get better at risk management, thus more money is a result of better risk management, nothing else. Those who still see risk management as preventing things from going wrong will differ with me here; those who understand that risk management is about management of risk and opportunity will understand and agree. The third key element after filtering the information overload is Change. The world is changing at an unprecedented pace, the levels of change are much bigger than before and change is happening much faster than before. During any phase of change the level of risk increases and new risks are introduced during the process, or sometimes because of the process. No business can exist without human intervention and there is a limit to the level of change and the pace at which any human can accept such disruption. So often, we see examples from the oil industry where they launch new a multitude of new projects, restructure, enter new markets, change operating systems or involve themselves in mergers and acquisitions; all at the same time.

The third key element after filtering the information overload is Change. The world is changing at an unprecedented pace, the levels of change are much bigger than before and change is happening much faster than before. During any phase of change the level of risk increases and new risks are introduced during the process, or sometimes because of the process. No business can exist without human intervention and there is a limit to the level of change and the pace at which any human can accept such disruption. So often, we see examples from the oil industry where they launch new a multitude of new projects, restructure, enter new markets, change operating systems or involve themselves in mergers and acquisitions; all at the same time. However, there is always the risk of employees seeking to maximise their bonuses who may take excessive risks, particularly if their bonuses or other incentives are based on immediate results and ignores long-term profitability and prudent risk management. In the oil industry there are numerous examples of major accidents occurring due to cutting corners in order to meet schedules, or risk management being silenced in order to hide true completion dates in order to achieve quarterly bonuses.

However, there is always the risk of employees seeking to maximise their bonuses who may take excessive risks, particularly if their bonuses or other incentives are based on immediate results and ignores long-term profitability and prudent risk management. In the oil industry there are numerous examples of major accidents occurring due to cutting corners in order to meet schedules, or risk management being silenced in order to hide true completion dates in order to achieve quarterly bonuses.

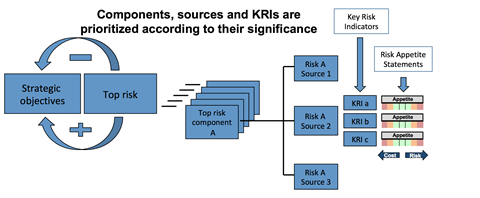

Of course there are many other tools you can use such as bowtie XP or risk information software generated dashboards. In this Episode, the final in the series, we discuss this and more….. Check out below the video for content and timings within the video:

Of course there are many other tools you can use such as bowtie XP or risk information software generated dashboards. In this Episode, the final in the series, we discuss this and more….. Check out below the video for content and timings within the video:

“Implementing Enterprise Risk Management – Case studies and best practices” published by Wiley’s and put together by Betty Simkins, John Fraser and Kristina Narvaez. The chapter specifically looks at how Risk Maturity was used to implement risk management within various organisations based out of the Middle East.

“Implementing Enterprise Risk Management – Case studies and best practices” published by Wiley’s and put together by Betty Simkins, John Fraser and Kristina Narvaez. The chapter specifically looks at how Risk Maturity was used to implement risk management within various organisations based out of the Middle East. Another book that is dedicated completely to Risk Maturity Models and which draws on some of the models I used in the above mentioned book is Domenic Antonucci’s book “Risk Maturity Models.

Another book that is dedicated completely to Risk Maturity Models and which draws on some of the models I used in the above mentioned book is Domenic Antonucci’s book “Risk Maturity Models.

There are a number of articles and courses out there that cover how to set up risk management within an organisation and how to identify risks, however some key focus areas for this industry is that ICO’s and STO’s need to be very clear as to their objectives and focus their efforts on Identifying and assessing their risks to these objectives whilst looking at solutions to mitigate them.

There are a number of articles and courses out there that cover how to set up risk management within an organisation and how to identify risks, however some key focus areas for this industry is that ICO’s and STO’s need to be very clear as to their objectives and focus their efforts on Identifying and assessing their risks to these objectives whilst looking at solutions to mitigate them. Often, improvement to the process or a better understanding of risk within companies & ICO’s, come from having non-executive directors (NEDS) or ICO advisors who have a wide variety of experience and who can add, for example, to the risk management process. Better still however, is having someone on board with a full understanding of risk management who will ultimately bring the most value as they work towards embedding risk management into the culture and decision making of the organisation. Especially in the case of ICO’s, which can make great use of a variety of advisors, it is an opportunity not to be missed. It is therefore important to choose your advisors and NEDS wisely.

Often, improvement to the process or a better understanding of risk within companies & ICO’s, come from having non-executive directors (NEDS) or ICO advisors who have a wide variety of experience and who can add, for example, to the risk management process. Better still however, is having someone on board with a full understanding of risk management who will ultimately bring the most value as they work towards embedding risk management into the culture and decision making of the organisation. Especially in the case of ICO’s, which can make great use of a variety of advisors, it is an opportunity not to be missed. It is therefore important to choose your advisors and NEDS wisely.